Research has shown that the development of family companies can fall into two, sometimes three, stages. This article discusses these stages in detail and shows how they can be useful to those in leadership roles.

Family offices have received increased attention and endorsement in our field over the past decade. Initially, the family office emerged to meet a very specific set of needs for business-owning families. However, as offices have become more widely adopted, a range of designs have been implemented — some successfully, others not. While our understanding of the evolution of family businesses from generation to generation has increased dramatically, the equally important changes in the family office have not been evaluated as fully. In particular, there has not been an application of the most useful family business models toward understanding how the family office fits into the overall development of the family enterprise. Our aim in this article is to sketch a developmental framework for the family office and examine the ways in which such a framework may be useful to those in leadership roles.

Two years ago we introduced a developmental model of change in family companies which proposed alternating periods of stability and of transition as the business moves from early, simpler structures to more complex ones. This model of structural change is based on a concept from the natural sciences: that while the pressure that drives change is continuous, change itself does not occur in gradual incremental steps, but rather in spurts. Like a glacier, a family enterprise is a growing, working system — constantly interacting with its environment, and balancing movement with stability. The forces at work in a glacier as it moves across the landscape are powerful and complex, but they are largely invisible. Over time, the pressure for movement builds in the river of ice. Then suddenly, when it has reached a state of “readiness,” it may only require a momentary trigger to initiate the calving of huge sections from the edge of the glacier into the sea, giving the glacier itself a new shape.

Applying this model to the evolution of family offices, we reviewed the histories of our cases in Europe and North America that had implemented some form of family office in the past decade. We found a remarkable consistency in their experiences, with some important lessons concerning best practices and common pitfalls. Overall, every case went through two stages: a “pre-office” stage, using advisors individually, and a “support service” stage, providing specific assistance for shareholders and their relatives. In addition, in those cases where the family business continued to evolve away from a single-company model to a more complex investment enterprise, the role of their family offices also continued to change. We called this emerging third stage “network integration”.

Stage 1: Pre-office stage

In the early days of a family business, the owner-operator typically uses the company’s staff and his or her own personal advisers to manage tax, legal and banking tasks. These are considered operational details; the real work is accumulating enough capital and talent to get the business off the ground. If the business succeeds, however, financial management can gradually take more and more effort. This is illustrated, for example, in the case of a successful entrepreneur who built a significant business, relying on the services and expertise of her staff to satisfy the financial needs of her family. Initially she requested that the company’s accountant prepare the taxes for her husband and children. Several years later she had the company’s lawyer establish a trust for her family. Her family’s financial and legal planning were intricately intertwined with the company, and she was trying to be efficient by using professionals whom she already knew and trusted, and who were completely familiar with all the details.

As the company grew, the need for service also grew. More family members entered the business. The advisers extended their assistance to the wider family as a convenience, and increasingly as a perk for family employees and shareholders. At first the help included preparing tax returns and wills; later the requests included advice or information on insurance, money management, mortgages and loans, and other requirements. Some of those contacted were company support staff;

others were outside professionals working for the company independently of each other. Some family members used the same advisors, and others did not.

Over time, the pressure built for a fundamental change. In this “pre-office” case, the trigger for structural change came from the company’s attorney. His staff began to complain about spending too much time in non-business activities, and to express concern about the inappropriate mixing of family and business matters. The advisors were often put in the uncomfortable position of deciding how to respond to direct requests for service from family members, some in the company, some shareholders, and some neither managers nor owners. The need for a more formal Family Office was suddenly clear to the leader. She asked her sister, who had been an accountant when she was younger and was now interested in getting involved since her youngest children were entering school, to help get it started. They used their family’s attorney to identify the right professionals, draft some rules for fair usage, and formalize the procedures for access. The attorney, who was a personal friend of the family and knew them all well, was able to put together a simple design which everyone accepted. In this case, a relatively small family and a growing but still-simple business, this process was completely adequate, and the transition to the second stage was completed.

Stage 2: The Family Office for support services

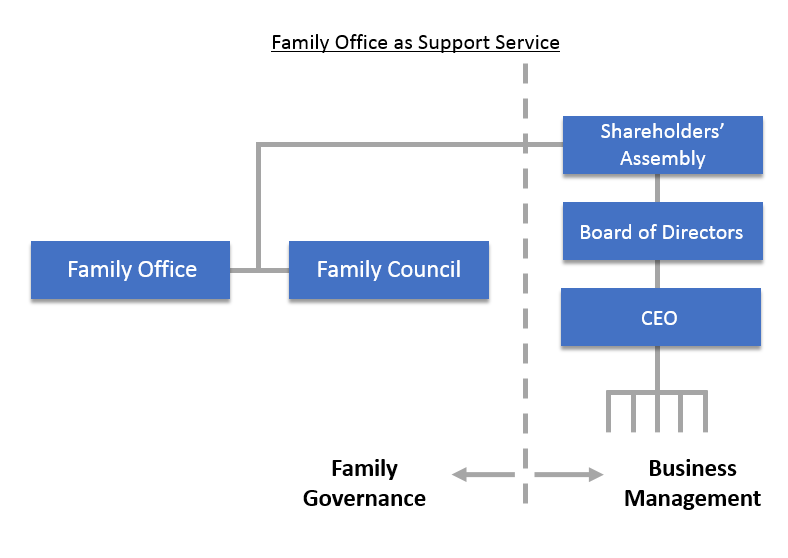

The increased interest in more formal (Stage 2) family offices has in part been facilitated by the input of professional advisors and family business educators themselves. As families and advisors listened to the message about the importance of separating the functions of the “three circles” — business, ownership, and family — it became clear that while the business circle had a structure of management and support services to help it perform its functions, and the owners increasingly had boards of directors, the family circles often had no organizational support at all. Many families responded with two efforts: a family council, to handle the interpersonal aspects of family ownership, and a family office, to handle the financial tasks.

As a result, like the example above, most of these family offices start out as “back-office” efforts, often involving family members who want to make a valid contribution to the family’s enterprises in some way but are not senior leaders in the company. They are typically backed up by the firm’s advisers or by one or two full time professionals — tax attorneys, accountants, trust specialists, and investment managers. The significant benefits of a formal, well-structured family office to these enterprises has been well documented. They provide technical services to family members, who want to benefit from economies of scale. The professional advice and direct service available to the family members is often far beyond what they would arrange for themselves, and frequently at a lower cost. The office also protects the interests of the company, for example by ensuring that shareholders are attending to tax matters in a timely fashion and with solutions that do not invite unwanted attention. And the office can play a role behind the scenes. At this stage, for example, it is likely that competition will arise between the family and the business for access to cash and liquidity. Owners and directors working in the business are likely to want retained earnings and other resources channelled into business growth and reinvestment. Those not in the business, however, are likely to want access to liquid funds to diversify their personal investment portfolios, so that their all their eggs are not in the family business basket. The family office can potentially provide essential data and expertise, often through the family council, to help deal with this tension.

As the benefits have been described, so have many of the subtle challenges. Much of the literature generated by advisors from their experience with family offices at this stage highlights the key dilemmas faced by family office staff:

How does the family understand the fundamental mission of the office? What expectations does the family have regarding the services that family office performs?

Which members of the family are chosen to sit on the family office board or in the investment committees?

Who is eligible to receive services?

How are the costs of the office allocated among family members?

How does the staff balance the interests of the company and of the individual family members, when they do not completely coincide?

While these questions can be addressed as policy issues within the office itself, we believe that is not the most productive approach. A narrow focus on the technical aspects of the work may lead professionals to overlook how the family office interacts over time with the broader family enterprise context. For example, at the beginning the issue of covering the costs of operation may be solved with a simple “fee for service” formula. However, as the business grows and moves through generational transitions, executive leadership (and the automatic perks that come with senior positions) often becomes increasingly concentrated in one family branch. At this stage the differences in wealth across family branches can become very significant — an underlying stress that usually remains unspoken. The discrepancy between the “insiders” and the “outlaws” may widen, putting pressure on early agreements about who has to pay for what. Differences in information may also be important, so that some family members may feel that even though they are “paying customers,” they no longer could abstain from the family office (and its core of company-bound tax accountants) even if they wanted to. Family office staff can find themselves repeatedly in the middle of misperceptions and honest glitches in communication, or more seriously, jealousies, individual and branch rivalries, and efforts to manipulate or coerce. Quite a challenge! Yet many family offices, who understand their embedded role in the overall family system, find a way to respond. The successful offices at this stage all shared at least two characteristics: 1) sensitive and excellent leadership, whether by a family member or a non-family professional; and 2) close integration with a well-functioning family council, where potentially divisive and controversial issues can be put on the table and discussed openly.

Whether the family office in Stage 2 is relatively conflict-free or is a lightning rod for family divisions, we have seen that the issues become even more complicated as the family enterprise continues to evolve. An increasing percentage of the families that we work with in the Cousin Consortium stage of ownership are facing significant restructuring of their enterprises — the core identity of their “family businesses” is changing. The particulars of the evolution may vary:

The original operating company may be augmented, or replaced, by a group of operating companies, each with a different ownership structure.

Other family-controlled units, such as a foundation, may be created.

The mechanics of ownership may evolve from simple partnerships or corporations to groups of trusts, limited family partnerships, multiple classes of stock, or holding companies.

The enterprise may become international, bringing new legal and financial complexities.

One-time significant events, such as an IPO, acquisition, or divestiture, may lead to sudden infusions of (or demands for) cash.

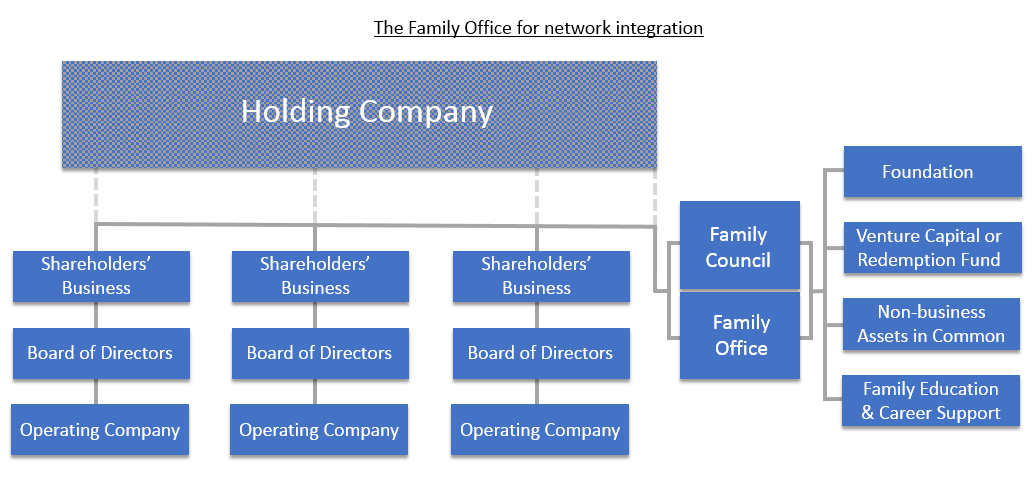

Once again, the “glacial” developmental pressure begins to build. The executive committee of the business and the family council can no longer lead and co-ordinate all this work. As family members change their identity from owner-managers to owner-investors, the tasks of asset allocation and wealth management move to center stage.

Stage 3: The Family Office for network integration

At this point, the Family Office needs to move as well, from support service to network integration. Family leaders need to recognize its central importance in relation to the family’s mission, the business’s strategy and the owners’ return on their investment. In these owner-investor family enterprises, the family council and the family office become the primary co-ordinating structures linking all aspects of the operation: wealth generation, wealth management, continuity, philanthropy, and the family legacy.

When this is the case, the family office reaches a third stage: network integrator. This redefinition raises once again some fundamental questions about resources, structure, and process.

1. What are its tasks? The family council is the forum for family governance. The family office is the information and services staff support for the council. Financial services and advising remain the office’s core “technology,” now in greatly expanded arenas. To these are added the additional new capabilities that the investor/owner family requires, such as education (from basic financial literacy to value-focused investing strategies), security, career development and guidance, global awareness, language skills, and so on.

2. Who will staff it? In several cases this was a very sensitive issue. What is to be done about the people who served the family office in the earlier days, now that the family office is dealing with subtle and far-reaching investment decisions and clearly needs the best talent available? Some family members who may have felt bruised because they did not get access to the core business, and who may have found a meaningful role in establishing the family office, will have to face up to being out of their depth, possibly for a second time in their career. Likewise, loyal advisers who helped the firm and the family office evolve may not be up to the level of sophistication that the family enterprise office requires and demands.

Where should it be located? Who will pay for it? Running a company is easier to understand than co-ordinating a Cousin Consortium of owners. Placing the Stage 3 family office in the center of the family’s executive suite conveys the message that the owner development tasks are now the core of the enterprise’s mission. Analysts and other observers may frown when they perceive that “family matters” are taking up valuable and tangible resources (space, funds, staff). There is a real challenge for those inside the business to educate those on the outside — both distant family members and those who observe and evaluate the performance of family firms — about the function of this kind of family office.

This developmental model of the family office has implications for all the stakeholder groups. At each stage, important questions must be addressed by family members, professionals, and their outside advisors. In conclusion, here are a few of the core dilemmas that family office leaders must confront as they guide their organizations through this process:

Family Members

Who decides what we will do when it’s time to re-configure the family office structure and function (when our glacier cracks & falls?)

How can the family’s identity and mission be preserved and expressed through the governance system (family office, family council, shareholders assembly and board), and avoid being lost or marginalized in the complex architechture of the family enterprise?

Professional Advisers

What additional skills and capabilities will I need to really understand the complexity of the system I’m working in?

What will my profession, and the other professions engaged in family offices, have to provide in terms of education and professional development for this new arena of professional services?

How do we resolve the profession-of-origin issues relating to conflict of interest, family politics and group dynamics?