At some point, all family enterprises will eventually wrestle with this question. You may be a first-generation Founder wondering why you would want to bother with a “real” Board or a Family Council. Why complicate things? Why involve people unnecessarily in decisions that are beyond their expertise?

Or you may be a second-generation Sibling Partnership resisting the need for more meetings to cope with issues that the first generation did not need to debate, like how we’ll work together as a sibling team or how to deal with owners who do not work in the business?

Or you may be a cousins consortium, highly experienced in corporate and family governance but running out of family members both willing and able to lead a large and diverse constituency of opinionated owners.

For many enterprising families, ensuring robust governance rarely seems as compelling or impactful as attending to the immediate opportunities and risks within a business or investment portfolio.

So, the real question should be: how much voice do they have, in what decisions, and where do these decisions get made?

By Ivan Lansberg and Katherine Grady

As enterprising families mature, they begin to appreciate that business, ownership, and family issues are intertwined in a way that will quickly get very complicated. Family members working in the company will expect a say in significant business decisions while recognizing that mid-level managers should not expect to have the same voice as their CEO cousin.

Furthermore, family owners not working in the business may feel they deserve a certain level of influence but don’t necessarily have a complete picture of the enterprise or understand all the implications of their recommendations and preferences. Such complexity can erupt into heated discussions resulting in ineffective decisions and complicated personal reactions. Sometimes, these discussions create scars that last year.

This is precisely when an effective family governance system can be most impactful – channeling all the stakeholders’ voice and involvement into the appropriate decision-making forums.

The Jetliner Metaphor

Imagine the family enterprise as a jetliner. As with any investment, the shareholders have a very legitimate right to expect a certain level of return based on an appropriate level of risk and to know that the plane is used in a way that aligns with their values. Owners have a right to know that the pilots are competent, but they do not have a right to enter the cockpit and fly the plane themselves just because they are owners — unless, of course, they are competent, licensed pilots and are selected by the family to do so.

In the first generation, the owners are almost always pilots, and there was no need to separate the issues into different decision-making forums. As the enterprise moves into later generations, however, decoupling governance and management roles is critical. Yes, you can still have owners in the cockpit if they are qualified and there is room, but other owners should be directed into governing entities where owners both can and should be involved.

The best place to start as you transition to greater governance is with the development of a Board of Directors and the creation of a Family Owners Council. Additional governing bodies like a Family or Shareholders Assembly, a Career Committee, a Family Foundation, and a Family Office or a Private Trust Company can come later. Usually, these forums link into the Council and the Board, which will serve as the coordinating pillars of the evolving governance structure.

Owners have a right to know that the pilots are competent, but they do not have a right to enter the cockpit and fly the plane themselves just because they are owners.

The Board of Directors

The Board needs to become the forum for overseeing the growth and performance of the business and is the place where the fundamental strategic issues facing the company are addressed. Management proposes the strategy, but it is the Board’s role to test the underlying assumptions and ensure that management has thought it through. Once the strategy is duly vetted and approved, the Board oversees the effective implementation and holds management accountable.

Boards usually develop over time to match the needs of the business and the family owners – moving from a rubber-stamping Board to a Board of Family Directors to an Advisory Board with Independent Directors, and ultimately to a Fiduciary Board with a majority of Independent Directors. Effective Boards often meet four to six times a year and develop the professional structure of business review and strategic planning.

Family Directors bring the values and views of the family shareholders as a whole to Board meetings. This structure provides a way to have family shareholders have a voice in critical decisions such as growth aspirations, risk, debt, dividends and major acquisitions, without Board members getting bogged down with family issues or family members dipping too far into the business.

The Family Owners Council

The Family Owners Council becomes the forum for discussing ownership and family matters and guides the development of the family shareholder group. An effective Council provides guidance to the Board regarding ownership and family interests and concerns and manages activities that provide continuity in family values, identity, engagement and education.

A Council might typically meet three or four times a year and take on such activities as periodic reviews with the Chairman, gathering expectations from family owners, development of ownership policies, designing educational and social events for family members, and assisting with annual meetings.

Overlapping Responsibilities

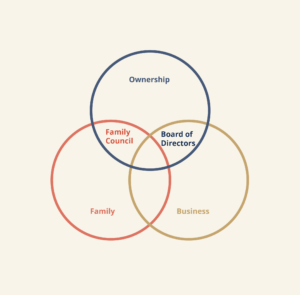

These two fundamental governing bodies can be mapped onto the familiar three-circle model that shows the interlocking stakeholder groups of business, owners, and family. The Board of Directors, which serves the shareholders, rightly belongs in the boundary between the Ownership and Business circles. The Council, which serves the family and the shareholders, finds its place on the boundary of the Owners and Family circles.

Later on, as the business grows and becomes even more formalized, it may be necessary to separate the family and the ownership forums by creating a Family Council to address the family’s evolving needs and a formal Shareholders’ Assembly to attend to the owners’ concerns.

While the architecture of governance matters hugely, any governing structure needs the right processes and people to make them work. The information sharing channel between the Board and the Family Owners Council is of particular importance, along with additional communication lines between any of the evolving governing bodies and with the shareholders at large.

A founder might scratch his or her head at all the meetings and letters effective stakeholder communication requires, but the siblings and the cousins who follow know that they are building a structure that will give them the best chance of succeeding for generations.

Remember – as ownership fragments with the passing of the generations, someone will be making decisions on all of these fundamental issues. Your choice is not whether things will change or not with the passage of time, they will. Your choice is whether you want to manage the transition to the future or not.

Thanks for joining the global community of families who use these insights to support their continuity. We look forward to sharing more with you in the next LGA Quarterly!

Sincerely,

Your LGA Team