Tim Kelly

Tim Kelly led three family offices over the last three decades and now helps families solve the multi-faceted challenges of managing generational wealth.

The world of family wealth is increasingly complex. Family offices are positioning themselves as comprehensive family support systems, with purpose-driven approaches becoming the primary differentiators.

Based on LGA’s 30 years of experience, thoughtful families seek solutions that address cross-border operations, multi-generational dynamics, and alignment of wealth management with long-term legacy preservation.

At LGA we believe understanding your family’s values and goals is the cornerstone of success. We begin by asking critical questions such as:

LGA’s Family Office Services help you make critical decisions about structure, governance, leadership succession, family participation models, funding, guiding values, and optimal service offerings at any stage of your journey.

We work with families to optimize the design and often redesign of family offices to achieve desired outcomes related to:

We develop tailored designs that integrate disparate activities into formalized purpose-based family offices with customized governance, operational structures, and effective leadership.

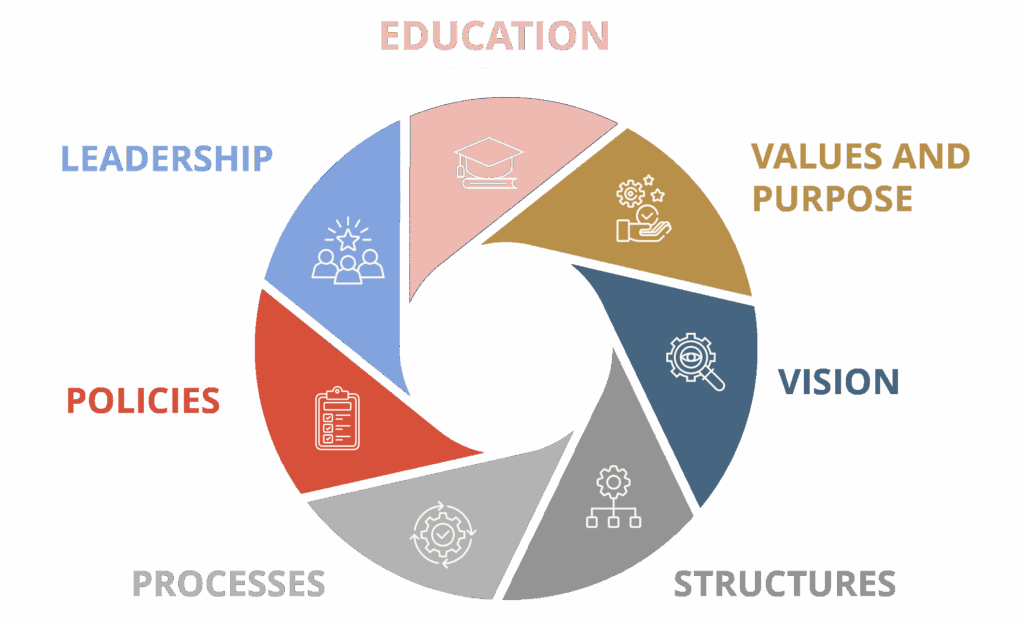

LGA developed The Seven Drivers of Continuity, a proprietary framework enabling systems-level analysis of family office operations to identify vulnerabilities and build actionable roadmaps.

This approach helps families move beyond operational structures to address essential alignment between family office purpose and family values and needs.

The Seven Drivers are: Values & Purpose, Vision, Structures, Processes, Policies, Leadership and Education

At LGA Advisors, we don’t just build family offices; we build legacies.

Tim Kelly led three family offices over the last three decades and now helps families solve the multi-faceted challenges of managing generational wealth.

Dimitris specializes in helping family enterprises and family offices navigate complex geopolitical, financial, and macroeconomic challenges.

Thomas is a Partner with LGA, where he leads the firm’s Global Practice for Family Offices and is the lead advisor for Asia.

Ernie is focused on designing, implementing, and supporting governance systems and educational programs within complex multi-generational family enterprises.

Isabel brings two decades of international wealth management expertise, serving as a dedicated advisor to wealthy and enterprising families. She is passionate about cultivating lasting relationships, built on a foundation of trust and an in-depth understanding of each family’s unique vision and legacy goals.

A successful family office will be a focal point for addressing a broad range of topics for a family.

This will include coordination of work from advisors on tax, legal, investment and other services.

The office should also have a strong risk management perspective.

The second-generation CEO of a large family enterprise was approached by a strategic investor who made a generous and unsolicited offer for their legacy operating business. The CEO had previously never explored a sale — both because of her strong emotional connection to the company and its employees — two of whom were her kids — and because of its attractive cash flow and growth profile.

Many family offices were established decades ago. Leaders of many offices are nearing retirement age. Recently an office, established in the early 90s with a non-family leader, engaged LGA to help them deal with executive transition. This office was set up by the wealth creator and operates as a Controlling Owner family office. The patriarch in his 80s had transferred ownership to the siblings in the next generation.

Family leaders must have the courage and stamina to create an inclusive, participative, and results-driven culture in the family and business, supported by the right policies and systems. Such a foundation will set the stage for a family legacy which both sustains across multiple future generations, and grows along the way with each group driving growth and diversification and making its own mark.

“Moments of crisis can bring families together or they tear them apart – the choice is ultimately theirs…”

Why is it hard to find good successors? We believe that the root issues occur earlier in the lives of next-gen members, linked to the manner in which they experience their family’s wealth and legacy during adolescence and early adulthood.

Many families have decided to formalize a Family Office to serve the financial and professional needs of family members.

As a result of our expertise, we are able to assist families across the spectrum of needs.